Declined and Cancelled Payments

Declined and canceled transactions are the result of safety precautions taken by FastSpring, or your customer’s payment provider. If a payment provider declines an order, FastSpring will have limited knowledge of the reasoning. Customers can contact the issuing bank for more information.

Declines

Your customer’s payment provider may decline a charge for one of the following reasons:

- Insufficient funds

- Inaccurate card information

- Suspicion of fraudulent activity.

You can search for the order to review status and failure details. However, FastSpring has limited knowledge of each decline. Customers should contact their provider for more information.

Cancellations

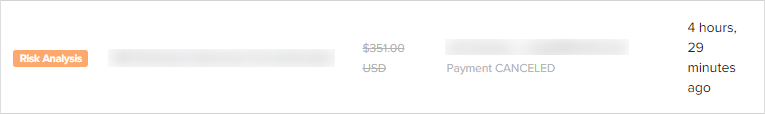

If an order fails FastSpring Fraud Detection, FastSpring marks it with a Risk Analysis tag, and cancels the payment. If you have questions regarding a canceled payment, contact FastSpring Support.

Credit Card Transactions

If an order passes risk analysis, the credit card issuer may still cancel the order for other reasons, including the following:

- Declined CVV2 code

- Invalid credit card information

- Insufficient funds

- Suspicious activity

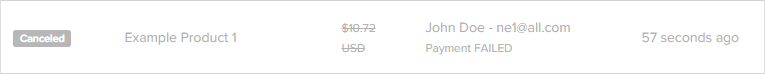

FastSpring will display the status as Canceled. Payment details will read Payment FAILED.

Click on the transaction to access its details page. The Method column in the Payments and Returns section may contain additional details, such as the following:

- RESTRICTED

- INSUFFICIENT_FUNDS

- Not authorized

- A procedure code such as Proc=110 or Proc=430285

However, FastSpring does not have additional information. Customers can contact their card issuer for more information.

Soft and Restricted Declines

Depending on the reasoning, credit card failures may result in a Soft Decline or Restricted Decline:

- Soft Decline: The bank that issued the card does not approve the transaction. However, you can try again later. FastSpring will attempt to route the transaction through a separate processing network for approval.

- Restricted Decline: The credit card is invalid. This may be linked to fraudulent activity which caused the bank to deactivate the card. If so, customers cannot use this card moving forward.

Customers may receive a charge on their credit card after a declined transaction. This is a temporary hold that will be removed within 5-10 business days.

PayPal Transactions

Failed status in the Payments and Returns section of a PayPal order indicates that the transaction was declined. The Method column in the Payments and Returns section may contain additional details. PayPal does not provide additional information.

Reasons for declined PayPal transactions include the following:

- The associated billing address is inaccurate or unconfirmed.

- The transaction exceeds the limit.

- The credit card company declined the transaction.

Customers can select an alternate payment method in PayPal to complete the transaction.

Customer-Facing Messaging

After a failed or declined transaction, FastSpring displays a message to the customer, explaining the invalid transaction. Messaging varies depending on the type of transaction or decline.

Credit Card Errors

- This transaction has been declined. Please use a different payment method or contact your bank. FastSpring did not receive a detailed decline reason. The customer should contact the issuing bank. They can choose a different payment method to complete the order.

- We regret that your order could not be accepted. We value your business and would like to help you complete this order. Please contact us for assistance. FastSpring or the issuing bank declined the transaction for fraud reasons. The customer should contact Consumer Support.

PayPal Errors

- An unexpected error occurred, and we are not currently able to accept payment. The transaction exceeded the customer’s limit. They should contact the bank that issues the card associated with the PayPal account.

Amazon Pay Errors

- An unexpected error occurred, and we are not currently able to accept payment. The order amount is too high. The customer should use a different payment method.

Updated 3 months ago